how to file back taxes without records canada

Determine whether you need to contact a tax preparer or you can handle the back taxes on. Filing back tax returns you havent completed could help you do one of the following.

Tax Season Shredding What To Keep How Long Shred Nations

This means that if there were several years where you did not file your taxes or did not file your taxes correctly you need to submit.

. Use an EFILE certified tax calculation software package. The experienced Chartered Professional. Citizens or resident aliens who have simple income tax returns and owe 1500 or less in taxes can qualify for the IRS procedure if the returns are within the last 3 tax years.

Prepare and file previous years income tax returns online with TurboTax Canada for 2020 2019 2018 2017 2016. To file back taxes start by determining which years you need to file and locating the W-2s 1099s or 1098s associated with those years. Filing this form with the CRA will extend the reassessment period for.

The penalty for filing taxes late is 5 of the tax years balance owing plus 1 of the balance owing for each full month your return is late up to a maximum of 12 months. You must disclose all undisclosed information to the CRA. Tax accounting software is popular in small businesses and appears to be sufficient for personal income tax filing.

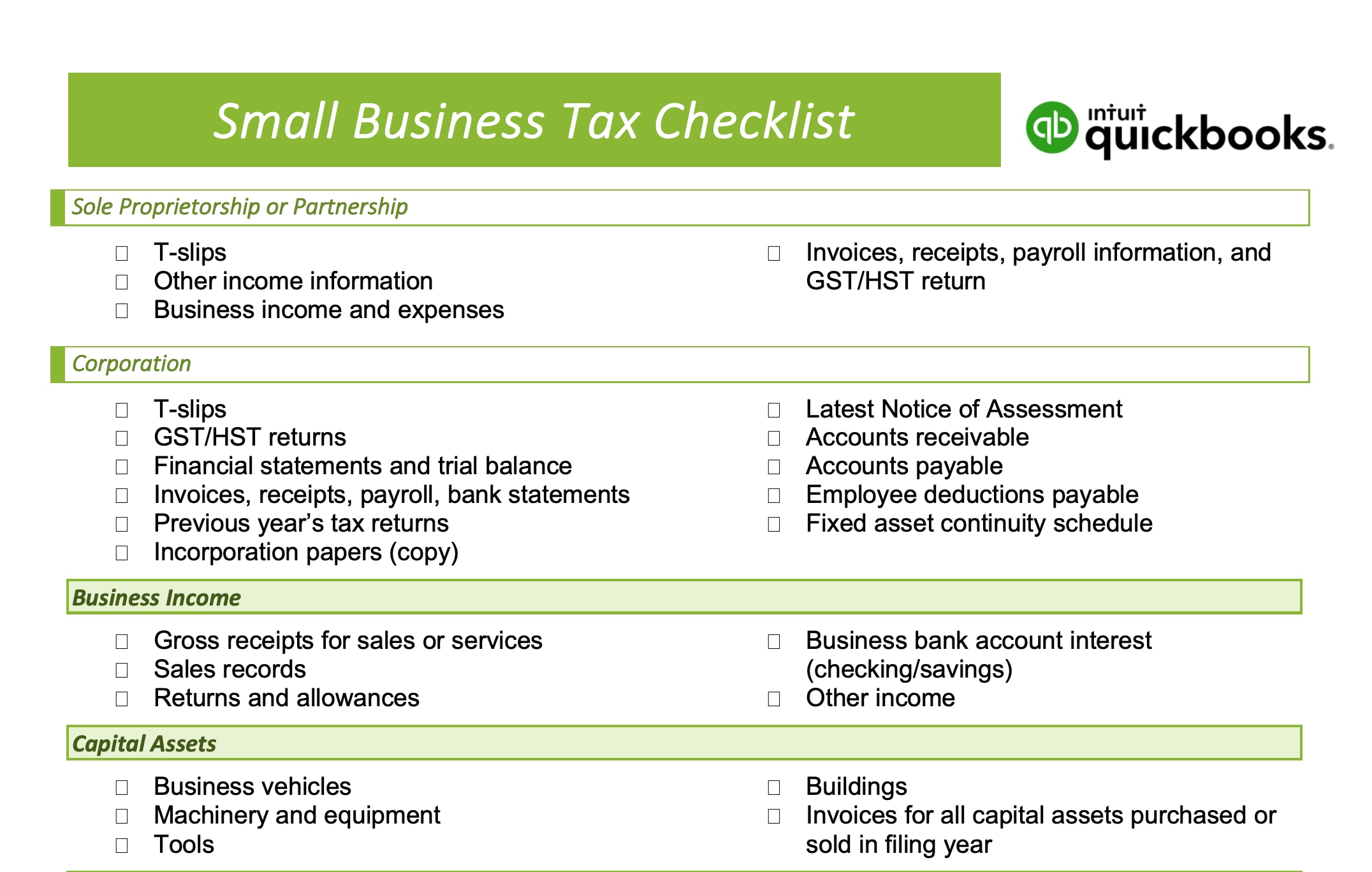

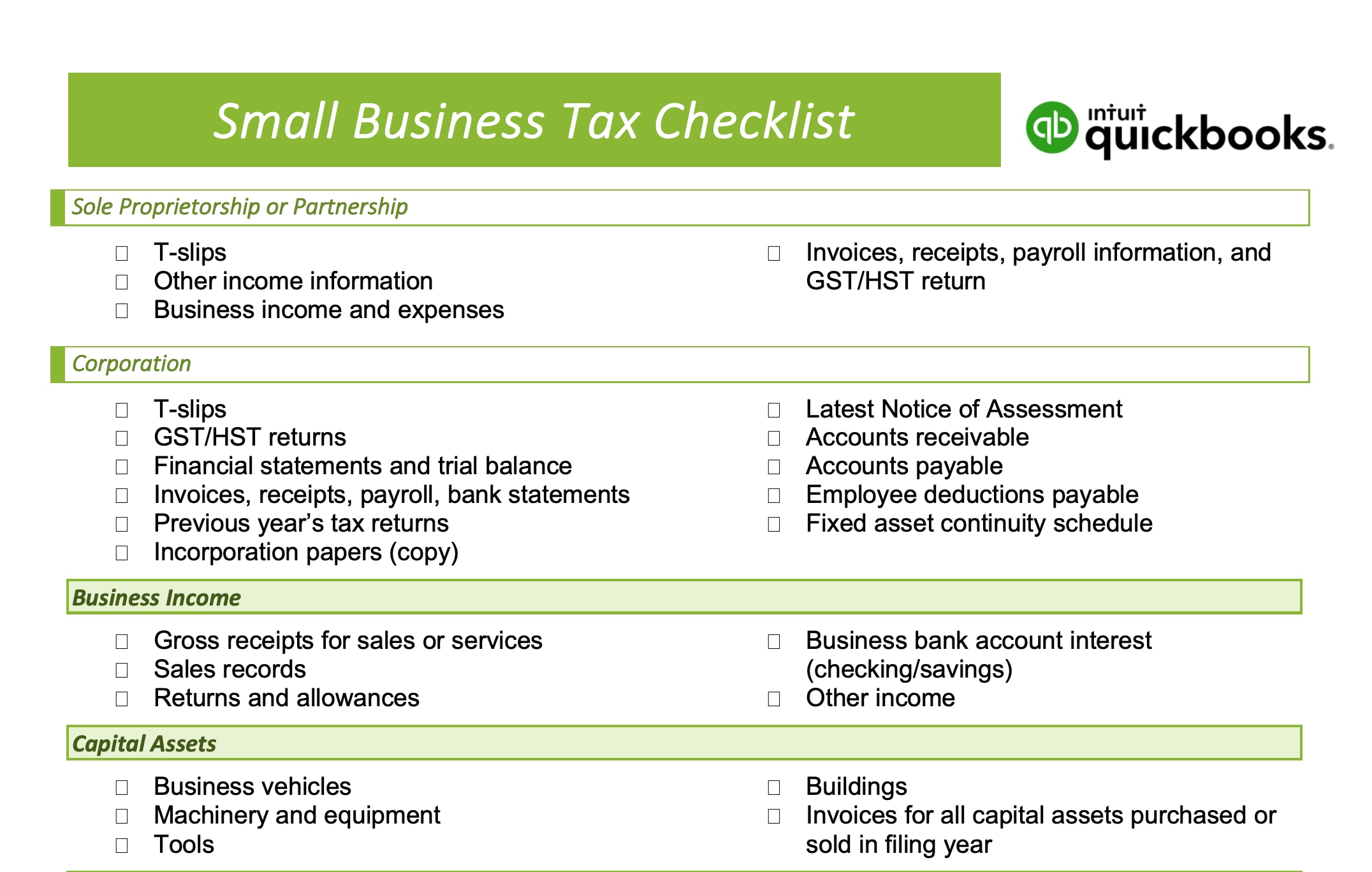

For personal returns you will need any and all T-slips such as T4s and T5s. Before consigning those dusty old tax returns to the shredder be sure to check the dates. For the 2021 tax year prior to filing your tax return electronically with NETFILE you will be asked to enter an Access code after your name date of birth and social insurance number.

A taxpayer has an option to sign Form T2029 Waiver in respect of the Normal Reassessment Period. Personally I set up an account with TurboTax and found the software. Contact Us by Email or call 1 855 TAX DOCS 1-855-829-3627 for a free no obligation consultation regarding all your back tax filing needs.

This an affordable option to hiring a tax accountant. One practical reason to file a back tax return is to see if the IRS. Steps to Filing Previous Years Tax Returns in Canada Do your Research.

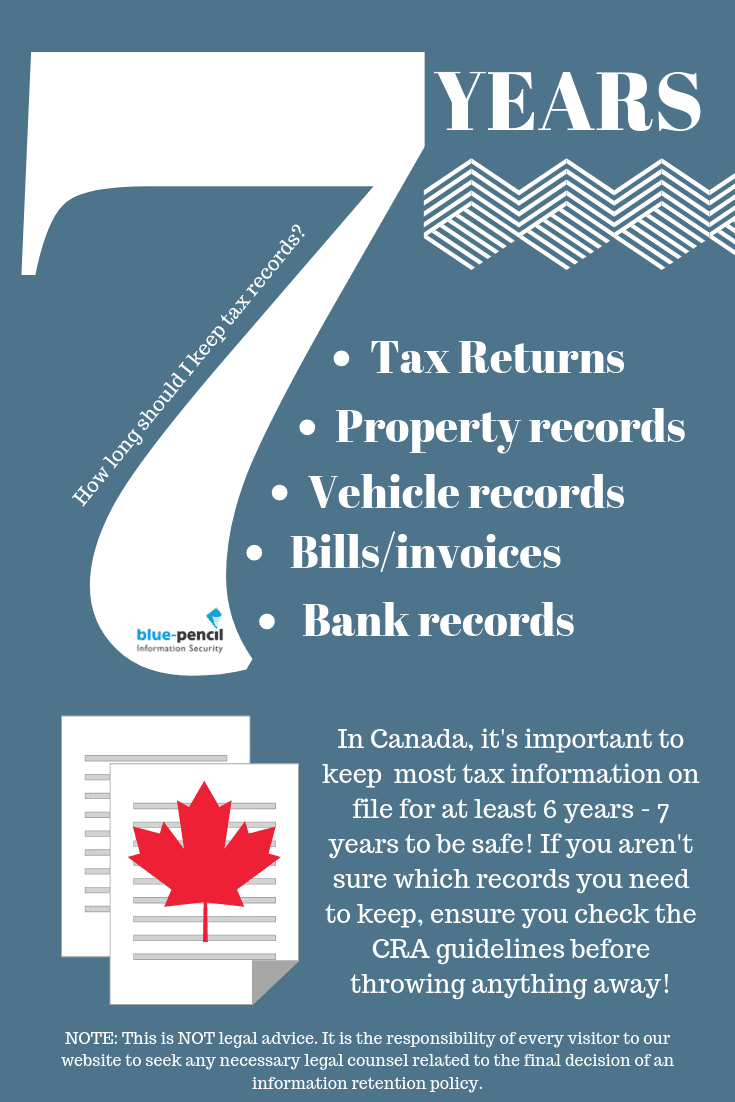

Get our online tax forms and instructions to file your past due return or order them by calling 1-800-Tax-Form 1-800-829-3676 or 1-800-829-4059 for TTYTDD. This program is designed as a second. The CRA expects you to hold onto tax returns and the supporting documents used to.

However this is only the. If youre self-employed youre responsible for deducting your income tax. There are many online programs that allow you to file your taxes such as SimpleTax or HR Block.

Access the EFILE web service to transmit your clients returns directly from your tax preparation software. All prices are subject to change without notice. If you are uncertain check with CRA or an accountant.

If you are missing any slips or are unsure if you have them all you. Its easiest to pay every month to avoid a.

How Long To Keep Tax Records In Canada Why

Tax Season Shredding What To Keep How Long Shred Nations

Record Retention Policy How Long To Keep Business Tax Record

How To File Small Business Taxes Quickbooks Canada

Non Resident Tax Return Sprintax Blog

Record Retention Policy How Long To Keep Business Tax Record

How Long To Keep Pay Stubs In Canada Blue Pencil

How To Prepare Your Crypto Taxes Bittrex Exchange

Are My Business Tax Returns Public Advice For Small Businesses

Record Retention Policy How Long To Keep Business Tax Record

How Long Does It Take To File Your Tax Return And Get Your Tax Refund Freshbooks

Avoid 6 Mistakes That Will Delay Your Irs Tax Refund

The Owner Operator S Quick Guide To Taxes Truckstop Com

Record Retention Policy How Long To Keep Business Tax Record

Should I Do My Own Taxes Or Hire An Accountant Use A Chart To Decide

Here S How Long You Should Keep Your Tax Records Forbes Advisor

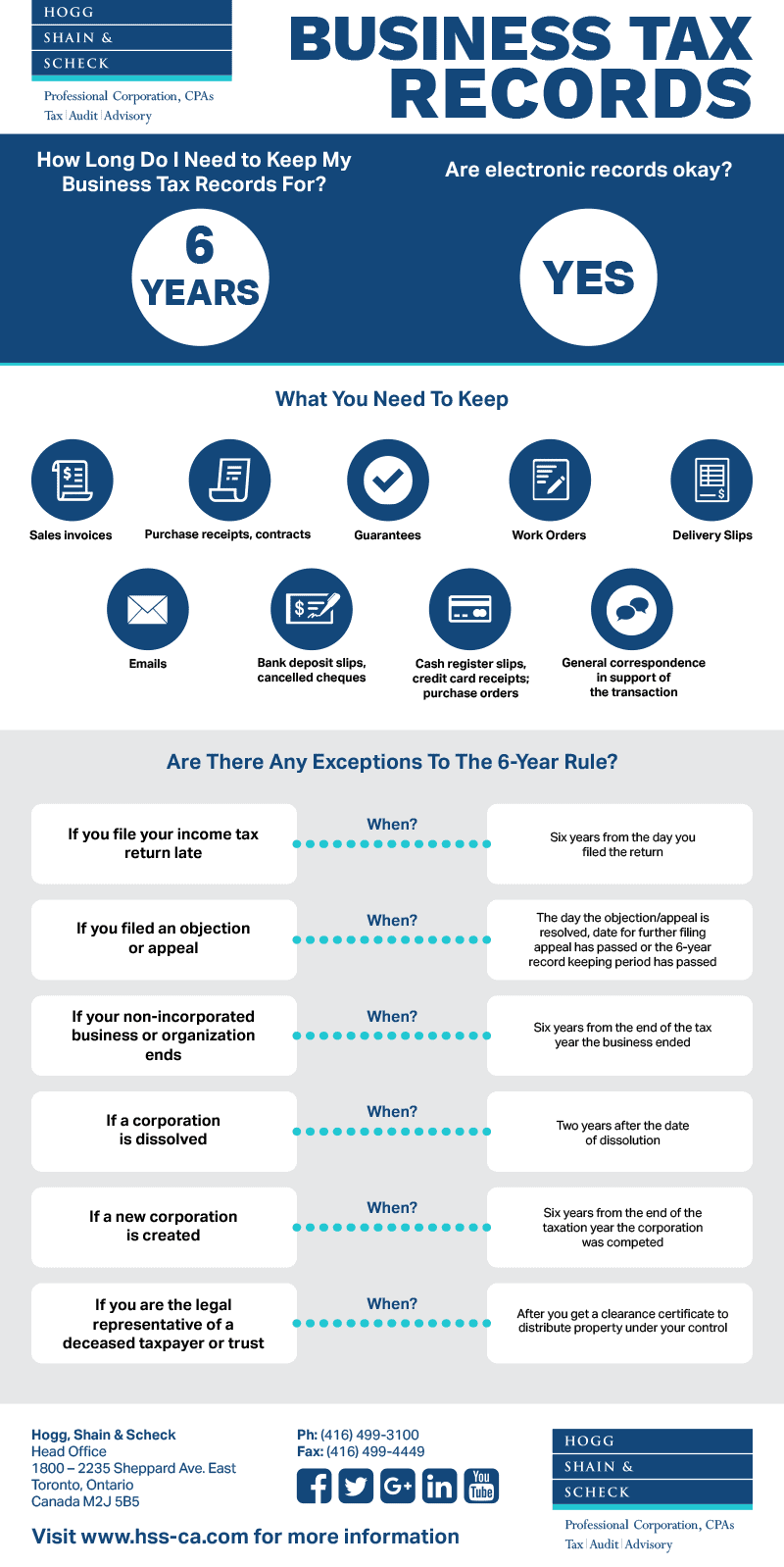

How Long Do I Need To Keep My Business Tax Records For Are Electronic Records Okay What You Need To Keep Are There Any Excepti